SharkShop Best Credit Cards for Earning Discounts on Purchases

SharkShop Best Credit Cards for Earning Discounts on Purchases

SharkShop Best Credit Cards for Earning Discounts on Purchases

Are you tired of watching your hard-earned money disappear with every swipe? What if we told you that each purchase could bring you closer to exciting discounts, exclusive offers, and even cash back? Enter the world of credit cards designed specifically for savvy shoppers like you! In this blog post, "SharkShop.biz Best Credit Cards for Earning Discounts on Purchases," we’ll dive into a curated selection of the most rewarding credit cards available today.

Whether you're a frequent flyer, a grocery guru, or simply someone who loves to treat themselves without breaking the bank, we've got the inside scoop on how to maximize your spending power. Get ready to turn those everyday expenses into extraordinary savings – let’s make every dollar count!

Introduction to Credit Cards and Discounts

In a world where savvy shoppers are always on the lookout for ways to save money, credit cards have become a powerful tool. They offer not just convenience but also opportunities to earn discounts on purchases. Imagine being able to buy your favorite things while racking up savings at the same time!

Credit cards designed for rewards and discounts can enhance your shopping experience, allowing you to treat yourself without feeling guilty about overspending. With so many options available, it’s easy to feel overwhelmed in the search for the perfect card that fits your lifestyle and spending habits.

At SharkShop.biz, we understand how important it is to get more bang for your buck. That’s why we’re here to guide you through everything you need to know about choosing the right credit card that can help maximize those discounts on everyday purchases. Let’s dive into this exciting world of credit card perks!

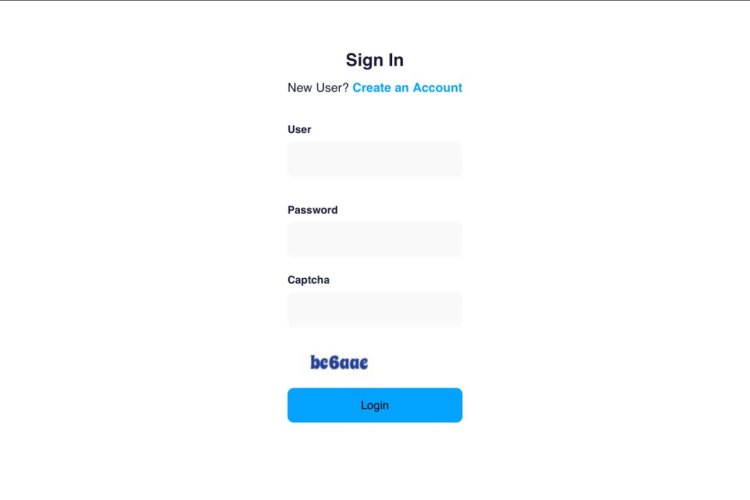

A Screenshot of Sharkshop (Sharkshop.biz) login page

Benefits of Using Credit Cards for Purchases

Sharkshop Credit cards offer more than just a convenient payment method. They provide an opportunity to earn rewards on everyday purchases. Each time you swipe, you could be accumulating points or cash back.

Many credit cards come with additional perks like travel insurance and purchase protection. This can give peace of mind when making significant buys or planning trips.

Moreover, using a credit card responsibly helps build your credit history. A solid credit score is essential for future financial endeavors such as loans and mortgages.

Another advantage is the ability to track spending easily through monthly statements. This feature aids in budgeting and managing finances effectively.

Finally, many cards include promotional offers that can enhance savings further. Seasonal sales or special events often mean extra discounts for cardholders, maximizing overall benefits.

Types of Credit Cards for Earning Discounts

When it comes to credit cards designed for earning discounts, options abound. Cashback credit cards are a popular choice. They offer a percentage back on every purchase you make, which can add up quickly.

Another type is the store-specific credit card. These cards provide significant savings at certain retailers or brands, making them ideal for frequent shoppers of those stores.

Travel rewards credit cards also deserve mention. They may not directly provide cash discounts, but they allow you to earn points that can be redeemed for travel-related expenses, effectively saving money on future trips.

Lastly, there are tiered reward cards that offer different levels of savings based on your spending categories. This flexibility allows cardholders to maximize their discount earnings in areas where they spend the most. Each type has unique features tailored to varying shopping habits and preferences.

How to Choose the Best Credit Card for You?

Choosing the best credit card tailored to your needs can feel overwhelming. Start by assessing your spending habits. Are you a frequent traveler or do you shop primarily at local stores?

Next, consider the rewards structure. Some cards offer cash back on groceries, while others provide points for travel-related expenses. Align these benefits with where you usually spend.

Don't forget about fees and interest rates. A low annual fee is ideal if you're not using the card often, but higher fees might be worth it if they come with substantial perks.

Check for introductory offers too; many cards have enticing bonuses for new users that can significantly enhance your savings initially.

Lastly, read customer reviews to gauge satisfaction levels and potential issues before making a decision. Being informed will lead to smarter choices in selecting a credit card that suits your lifestyle perfectly.

SharkShop's Top Picks for Credit Cards with Discounts

At SharkShop login, we know how important it is to find the right credit card that not only offers discounts but also aligns with your spending habits. Here are some top picks you shouldn't miss.

The **Cashback Rewards Card** shines for everyday purchases. You’ll earn a percentage back on groceries, gas, and online shopping. Plus, introductory bonuses make it even sweeter.

For travel enthusiasts, consider the **Travel Points Credit Card**. Accumulate points on every purchase which can be redeemed for flights or hotel stays. It’s perfect if you love exploring new destinations while saving money.

Then there's the **Store-Specific Discount Card**, ideal if you're loyal to certain retailers. Enjoy exclusive offers and cashback when buying from your favorite brands directly through SharkShop's network.

Each of these cards provides unique benefits tailored to different lifestyles, ensuring you get maximum value out of your spending!

Tips for Maximizing Your Discount Earnings

To truly maximize your discount earnings, start by familiarizing yourself with the rewards program of your credit card. Each card has unique features; knowing them can help you strategize your purchases.

Consider using your credit card for everyday expenses. Groceries, gas, and even bills often earn points or cashback that add up quickly over time.

Don’t shy away from bonus categories. Many cards offer extra cash back in specific categories like dining, travel, or shopping during certain months.

Take advantage of promotional offers and seasonal sales. Some cards will double points for specific retailers or on particular days.

Lastly, use apps to track and manage your rewards effectively. This way, you're always aware of what’s available to redeem when you’re ready to shop again.

Other Perks and Rewards of Using Credit Cards at SharkShop

Using credit cards at SharkShop cc offers more than just discounts. Many of these cards come with attractive cashback programs. Every time you shop, you earn a percentage back on your purchases.

Additionally, cardholders often enjoy exclusive access to sales and promotions. This means being the first to know about special events or product launches.

Travel enthusiasts will appreciate bonus points that can be redeemed for travel expenses. These perks can make planning your next adventure feel effortless.

Many credit cards also offer purchase protection and extended warranties on eligible products. This adds an extra layer of security when making big-ticket purchases.

Lastly, membership rewards may include free shipping on certain items or priority customer service. It’s all about enhancing the shopping experience while saving money along the way.

Things to Consider Before Applying for a Credit Card

Before applying for a credit card, it’s essential to understand your financial situation. Take stock of your income, expenses, and existing debt. This self-assessment will help you determine how much credit you can responsibly manage.

Next, consider the interest rates associated with different cards. Higher rates can lead to increased debt if balances aren't paid in full each month. Look for cards that offer introductory 0% APR periods if you're planning large purchases.

Additionally, evaluate the fees linked to the credit card. Annual fees or foreign transaction charges can diminish any potential discounts or rewards you earn.

Lastly, review your spending habits. Some cards cater specifically to certain categories like groceries or travel while others are more general-purpose. Choosing one aligned with your lifestyle maximizes benefits and savings over time.

Conclusion: Is a Credit Card with Discounts Right for You?

Sharkshop.biz Choosing a credit card with discounts can be a smart move for many consumers. If you frequently make purchases at certain retailers or want to maximize your savings on everyday expenses, these cards might offer significant benefits.

However, it’s essential to evaluate your spending habits and needs before deciding. Consider the rewards program, annual fees, and interest rates associated with each card. Some cards may provide impressive discount opportunities but come with high-interest charges if you're not careful about paying off balances promptly.

Ultimately, a credit card that offers discounts can enhance your shopping experience and help you save more money in the long run. Just ensure it aligns well with your financial goals and lifestyle choices. By making an informed decision, you can enjoy all the perks while avoiding pitfalls associated with credit usage.

What's Your Reaction?